Card Brand Updates

continuously update their interchange rate and fee structures for specific categories. We will regularly

communicate these updates on this page.

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated December 2024

We wanted to make you aware that Visa and Mastercard are making several rate changes that will go into effect beginning in April 2025. These rate changes could impact your business based on your current pricing method and the types of payments that your business accepts.

Visa

- Effective April 11, 2025, Visa will increase the rate for the Standard Infinite Business Interchange program:

|

Charge Type |

Description |

Short Description |

October 2024 Rate % |

October 2024 Per Item |

April 2025 Rate % |

April 2025 Per Item |

|

2363 |

Standard – Infinite Bus |

STAND IB |

2.25% |

$ - |

2.35% |

$ - |

- Effective April 11, 2025, Visa will eliminate the following Domestic Prepaid Interchange programs. The Consumer Electronic/Standard and Commercial Standard programs will remain:

|

Charge Type |

Description |

Short Description |

|

2962 |

V CNP PREPAID |

V CNP PP |

|

2053 |

RECURRING PAYMENT - PREPAID CONS |

RECPMT PPD |

|

2949 |

V RESTAURANT PREPAID |

VRSTRNT PP |

|

2950 |

V CHIP RESTAURANT PREPAID |

CPRSTRNTPP |

|

2957 |

V EVERYDAY NEEDS PREPAID |

V EVRYDYPP |

|

2958 |

V CHIP EVERYDAY NEEDS PREPAID |

CPEVRYDYPP |

|

2063 |

SRVC STATION ELECTIONIC-PPD CONS |

SRVC PPD |

|

2058 |

SERVICE STATION CHIP - PPD CONS |

SRVCCH PPD |

|

2073 |

SUPERMARKET ELECTRONIC-PPD CONS |

SMKT PPD |

|

2068 |

SUPERMARKET CHIP - PREPAID CONS |

SMKT CHPPD |

|

2895 |

EMERGING MRKT STANDARD PREPAID |

EMRGSTDPP |

|

2896 |

CHIP EMERGING MRKT STANDARD PP |

EMCHPSTDPP |

|

2083 |

TIER 1 ELECTRONIC - PREPAID CONS |

TIER 1 PPD |

|

2078 |

TIER 1 CHIP - PREPAID CONS |

TR1CHP PPD |

|

2123 |

NON-CHIP ELECT - PREPAID COMM |

ELCT PPD C |

|

2128 |

CHIP ELECTRONIC - PREPAID COMM |

CHP PPD C |

|

2143 |

RECURRING PAYMENT - PREPAID COMM |

RECPMTPPDC |

|

2152 |

SRVC STATION ELECTIONIC-PPD COMM |

SRVC PPD C |

|

2148 |

SERVICE STATION CHIP - PPD COMM |

SRVCCHPPDC |

|

2162 |

SUPERMARKET ELECTRONIC-PPD COMM |

SMKT PPD C |

|

2157 |

SUPERMARKET CHIP - PREPAID COMM |

SMKTCHPPDC |

|

2900 |

EMERGING MRKT STANDARD COMM PP |

EMRGSTDCPP |

|

2901 |

CHIP EMERGE MRKT STND COMM PP |

EMCHSTDCPP |

|

2172 |

TIER 1 ELECTRONIC - PREPAID COMM |

TR 1 PPD C |

|

2167 |

TIER 1 CHIP - PREPAID COMM |

TR1CH PPDC |

- Effective April 11, 2025, Visa will eliminate the following Domestic Business Interchange programs. The Commercial Electronic/Standard programs will remain:

|

Charge Type |

Description |

Short Description |

|

2120 |

NON-CHIP ELECTRONIC - BUSINESS |

ELECT BUS |

|

2125 |

CHIP ELECTRONIC - BUSINESS |

CHP ELCT B |

|

2309 |

NON-CHIP ELECT INF PRVLG BUS |

ELECT IPB |

|

2315 |

CHIP ELECT INF PRVLG BUS |

CHPELECIPB |

|

2140 |

RECURRING PAYMENT - BUSINESS |

RECPMT BUS |

|

2290 |

RECURRING PAYMENT INF PRVLG BUS |

RECPMT IPB |

|

2149 |

SRVC STATION ELECTRONIC-BUSINESS |

SRVC BUS |

|

2145 |

SERVICE STATION CHIP - BUSINESS |

SRVC CHP B |

|

2291 |

SERVICE STATION INF PRVLG BUS |

SRVC IPB |

|

2292 |

SERVICE STATION CHIP INFPRVLGBUS |

SRVCCHPIPB |

|

2159 |

SUPERMARKET ELECTRONIC-BUSINESS |

SMKT BUS |

|

2154 |

SUPERMARKET CHIP - BUSINESS |

SMKT CHP B |

|

2293 |

SUPERMARKET ELECT INF PRVLG BUS |

SMKT IPB |

|

2294 |

SUPERMARKET CHIP INF PRVLG BUS |

SMKTCHPIPB |

|

2410 |

EMERGING MRKT ELECT BUSINESS |

EMRG BUS |

|

2411 |

EMERGING MRKT CHIP - BUSINESS |

EMRGCHPBUS |

|

2413 |

EMERGING MRKT CHIP STANDARD BUS |

EMCPSTDBUS |

|

2414 |

EMERGING MRKT STANDARD BUS |

EMRGSTDBUS |

|

21013 |

EMERMRKT CHIP STAND INF PRVLGBUS |

EMCPSTDIPB |

|

21014 |

EMERMRKT STAND INF PRVLGBUS |

EMRGSTDIPB |

|

2169 |

TIER 1 ELECTRONIC - BUSINESS |

TIER 1 BUS |

|

2164 |

TIER 1 CHIP - BUSINESS |

TR1 CHP B |

|

2298 |

TIER 1 ELECT INF PRVLG BUS |

TIER 1 IPB |

|

2299 |

TIER 1 CHIP INF PRVLG BUS |

TR1CHP IPB |

Mastercard

- Effective April 11, 2025, Mastercard will introduce new Interchange programs for new Mastercard Wholesale Travel program products:

|

Charge Type |

Description |

Short Description |

April 2025 Rate % |

April 2025 Per Item |

|

22277 |

MC CAD DOM B2B MBL |

M CAB2BMBL |

TBA |

$ - |

|

22278 |

MC CAD DOM B2B MBN |

M CAB2BMBN |

TBA |

$ - |

|

22279 |

MC CAD DOM B2B MBO |

M CAB2BMBO |

TBA |

$ - |

|

22280 |

MC CAD DOM B2B MBQ |

M CAB2BMBQ |

TBA |

$ - |

|

22281 |

MC CAD DOM B2B MBR |

M CAB2BMBR |

TBA |

$ - |

|

22282 |

MC INTL CAD B2B MBL |

MICAB2BMBL |

TBA |

$ - |

|

22283 |

MC INTL CAD B2B MBN |

MICAB2BMBN |

TBA |

$ - |

|

22284 |

MC INTL CAD B2B MBO |

MICAB2BMBO |

TBA |

$ - |

|

22285 |

MC INTL CAD B2B MBQ |

MICAB2BMBQ |

TBA |

$ - |

|

22286 |

MC INTL CAD B2B MBR |

MICAB2BMBR |

TBA |

$ - |

- Effective April 11, 2025, Mastercard will introduce new interchange programs for the New Mastercard Flex program products:

|

Charge Type |

Description |

Short Description |

April 2025 Rate % |

April 2025 Per Item |

|

22207 |

MC CAN DOM B2B WAA PRODUCT 1 |

M CAB2BWAA |

0.50% |

$ - |

|

22208 |

MC CAN DOM B2B WAB PRODUCT 2 |

M CAB2BWAB |

0.55% |

$ - |

|

22209 |

MC CAN DOM B2B WAC PRODUCT 3 |

M CAB2BWAC |

0.60% |

$ - |

|

22210 |

MC CAN DOM B2B WAD PRODUCT 4 |

M CAB2BWAD |

0.65% |

$ - |

|

22211 |

MC CAN DOM B2B WAE PRODUCT 5 |

M CAB2BWAE |

0.70% |

$ - |

|

22212 |

MC CAN DOM B2B WAF PRODUCT 6 |

M CAB2BWAF |

0.75% |

$ - |

|

22213 |

MC CAN DOM B2B WAG PRODUCT 7 |

M CAB2BWAG |

0.80% |

$ - |

|

22214 |

MC CAN DOM B2B WAH PRODUCT 8 |

M CAB2BWAH |

0.85% |

$ - |

|

22215 |

MC CAN DOM B2B WAI PRODUCT 9 |

M CAB2BWAI |

0.90% |

$ - |

|

22216 |

MC CAN DOM B2B WAJ PRODUCT 10 |

M CAB2BWAJ |

0.95% |

$ - |

|

22217 |

MC CAN DOM B2B WAK PRODUCT 11 |

M CAB2BWAK |

1.00% |

$ - |

|

22218 |

MC CAN DOM B2B WAL PRODUCT 12 |

M CAB2BWAL |

1.05% |

$ - |

|

22219 |

MC CAN DOM B2B WAM PRODUCT 13 |

M CAB2BWAM |

1.10% |

$ - |

|

22220 |

MC CAN DOM B2B WAN PRODUCT 14 |

M CAB2BWAN |

1.15% |

$ - |

|

22221 |

MC CAN DOM B2B WAO PRODUCT 15 |

M CAB2BWAO |

1.20% |

$ - |

|

22222 |

MC CAN DOM B2B WAP PRODUCT 16 |

M CAB2BWAP |

1.25% |

$ - |

|

22223 |

MC CAN DOM B2B WAQ PRODUCT 17 |

M CAB2BWAQ |

1.30% |

$ - |

|

22224 |

MC CAN DOM B2B WAT PRODUCT 18 |

M CAB2BWAT |

1.35% |

$ - |

|

22225 |

MC CAN DOM B2B WAU PRODUCT 19 |

M CAB2BWAU |

1.40% |

$ - |

|

22226 |

MC CAN DOM B2B WAV PRODUCT 20 |

M CAB2BWAV |

1.45% |

$ - |

|

22227 |

MC CAN DOM B2B WAW PRODUCT 21 |

M CAB2BWAW |

1.50% |

$ - |

|

22228 |

MC CAN DOM B2B WAX PRODUCT 22 |

M CAB2BWAX |

1.55% |

$ - |

|

22229 |

MC CAN DOM B2B WAY PRODUCT 23 |

M CAB2BWAY |

1.60% |

$ - |

|

22230 |

MC CAN DOM B2B WAZ PRODUCT 24 |

M CAB2BWAZ |

TBA |

$ - |

|

22231 |

MC CAN DOM B2B WBA PRODUCT 25 |

M CAB2BWBA |

TBA |

$ - |

|

22232 |

MC CAN DOM B2B WBB PRODUCT 26 |

M CAB2BWBB |

TBA |

$ - |

|

22233 |

MC CAN DOM B2B WBC PRODUCT 27 |

M CAB2BWBC |

TBA |

$ - |

|

22234 |

MC CAN DOM B2B WBD PRODUCT 28 |

M CAB2BWBD |

TBA |

$ - |

|

22235 |

MC CAN DOM B2B WBF PRODUCT 29 |

M CAB2BWBF |

TBA |

$ - |

|

22236 |

MC CAN DOM B2B WBG PRODUCT 30 |

M CAB2BWBG |

TBA |

$ - |

|

22237 |

MC CAN DOM B2B WBH PRODUCT 31 |

M CAB2BWBH |

TBA |

$ - |

|

22238 |

MC CAN DOM B2B WBI PRODUCT 32 |

M CAB2BWBI |

TBA |

$ - |

|

22239 |

MC CAN DOM B2B WBJ PRODUCT 33 |

M CAB2BWBJ |

TBA |

$ - |

|

22240 |

MC CAN DOM B2B WBK PRODUCT 34 |

M CAB2BWBK |

TBA |

$ - |

|

22241 |

MC CAN DOM B2B WBL PRODUCT 35 |

M CAB2BWBL |

TBA |

$ - |

|

22242 |

MC CAN INTL B2B WAA PRODUCT 1 |

MICAB2BWAA |

0.50% |

$ - |

|

22243 |

MC CAN INTL B2B WAB PRODUCT 2 |

MICAB2BWAB |

0.55% |

$ - |

|

22244 |

MC CAN INTL B2B WAC PRODUCT 3 |

MICAB2BWAC |

0.60% |

$ - |

|

22245 |

MC CAN INTL B2B WAD PRODUCT 4 |

MICAB2BWAD |

0.65% |

$ - |

|

22246 |

MC CAN INTL B2B WAE PRODUCT 5 |

MICAB2BWAE |

0.70% |

$ - |

|

22247 |

MC CAN INTL B2B WAF PRODUCT 6 |

MICAB2BWAF |

0.75% |

$ - |

|

22248 |

MC CAN INTL B2B WAG PRODUCT 7 |

MICAB2BWAG |

0.80% |

$ - |

|

22249 |

MC CAN INTL B2B WAH PRODUCT 8 |

MICAB2BWAH |

0.85% |

$ - |

|

22250 |

MC CAN INTL B2B WAI PRODUCT 9 |

MICAB2BWAI |

0.90% |

$ - |

|

22251 |

MC CAN INTL B2B WAJ PRODUCT 10 |

MICAB2BWAJ |

0.95% |

$ - |

|

22252 |

MC CAN INTL B2B WAK PRODUCT 11 |

MICAB2BWAK |

1.00% |

$ - |

|

22253 |

MC CAN INTL B2B WAL PRODUCT 12 |

MICAB2BWAL |

1.05% |

$ - |

|

22254 |

MC CAN INTL B2B WAM PRODUCT 13 |

MICAB2BWAM |

1.10% |

$ - |

|

22255 |

MC CAN INTL B2B WAN PRODUCT 14 |

MICAB2BWAN |

1.15% |

$ - |

|

22256 |

MC CAN INTL B2B WAO PRODUCT 15 |

MICAB2BWAO |

1.20% |

$ - |

|

22257 |

MC CAN INTL B2B WAP PRODUCT 16 |

MICAB2BWAP |

1.25% |

$ - |

|

22258 |

MC CAN INTL B2B WAQ PRODUCT 17 |

MICAB2BWAQ |

1.30% |

$ - |

|

22259 |

MC CAN INTL B2B WAT PRODUCT 18 |

MICAB2BWAT |

1.35% |

$ - |

|

22260 |

MC CAN INTL B2B WAU PRODUCT 19 |

MICAB2BWAU |

1.40% |

$ - |

|

22261 |

MC CAN INTL B2B WAV PRODUCT 20 |

MICAB2BWAV |

1.45% |

$ - |

|

22262 |

MC CAN INTL B2B WAW PRODUCT 21 |

MICAB2BWAW |

1.50% |

$ - |

|

22263 |

MC CAN INTL B2B WAX PRODUCT 22 |

MICAB2BWAX |

1.55% |

$ - |

|

22264 |

MC CAN INTL B2B WAY PRODUCT 23 |

MICAB2BWAY |

1.60% |

$ - |

|

22265 |

MC CAN INTL B2B WAZ PRODUCT 24 |

MICAB2BWAC |

TBA |

$ - |

|

22266 |

MC CAN INTL B2B WBA PRODUCT 25 |

MICAB2BWBA |

TBA |

$ - |

|

22267 |

MC CAN INTL B2B WBB PRODUCT 26 |

MICAB2BWBB |

TBA |

$ - |

|

22268 |

MC CAN INTL B2B WBC PRODUCT 27 |

MICAB2BWBC |

TBA |

$ - |

|

22269 |

MC CAN INTL B2B WBD PRODUCT 28 |

MICAB2BWBD |

TBA |

$ - |

|

22270 |

MC CAN INTL B2B WBF PRODUCT 29 |

MICAB2BWBF |

TBA |

$ - |

|

22271 |

MC CAN INTL B2B WBG PRODUCT 30 |

MICAB2BWBG |

TBA |

$ - |

|

22272 |

MC CAN INTL B2B WBH PRODUCT 31 |

MICAB2BWBH |

TBA |

$ - |

|

22273 |

MC CAN INTL B2B WBI PRODUCT 32 |

MICAB2BWBI |

TBA |

$ - |

|

22274 |

MC CAN INTL B2B WBJ PRODUCT 33 |

MICAB2BWBJ |

TBA |

$ - |

|

22275 |

MC CAN INTL B2B WBK PRODUCT 34 |

MICAB2BWBK |

TBA |

$ - |

|

22276 |

MC CAN INTL B2B WBL PRODUCT 35 |

MICAB2BWBL |

TBA |

$ - |

- Effective April 11, 2025, Mastercard will introduce a new fee for transactions using the New Mastercard Flex program product:

|

Charge Type |

Description |

Short Description |

April 2025 Rate % |

April 2025 Per Item |

|

702 |

MasterCard Flex Program Fee |

FLEXPGM |

0.113% |

$ - |

We appreciate your business and are available to answer any questions you may have.

Visa and Mastercard Small Merchant Interchange

To comply with recent rate reduction requirements implemented by the Canadian government, Visa and Mastercard will introduce new Small Merchant interchange categories for eligible customers. To qualify for Visa’s program, annual processing volume must be below $300,000 CAD. To qualify for Mastercard’s program, annual processing volume must be below $175,000 CAD. Eligibility is based on the previous 12 months of processing volume. (If your business has been open less than 12 months, your eligibility will be based on projected annual volume.)

As a result of this new program, you will receive the following new interchange categories:

|

Brand |

Description |

IC Rate |

Brand |

Description |

IC Rate |

|

|

VISA |

Small Merchant Consumer CP |

0.81% |

M/C |

MC Dom E-Commerce World Elite |

2.03% |

|

|

VISA |

Small Merchant Infinite CP |

0.99% |

M/C |

MC Dom E-Commerce Muse |

2.15% |

|

|

VISA |

Small Merchant Infinite Privilege CP |

1.80% |

M/C |

MC Dom Paypass Core |

0.72% |

|

|

VISA |

Small Merchant Consumer CNP Token |

1.25% |

M/C |

MC Dom Paypass World |

0.95% |

|

|

VISA |

Small Merchant Infinite CNP Token |

1.50% |

M/C |

MC Dom Paypass World Elite |

1.22% |

|

|

VISA |

Small Merchant Infinite Privilege CNP Token |

2.25% |

M/C |

MC Dom Paypass Muse |

1.29% |

|

|

VISA |

Small Merchant Consumer CNP |

1.30% |

M/C |

MC Dom 3Ds E-Comm Secure Core |

1.40% |

|

|

VISA |

Small Merchant Infinite CNP |

1.55% |

M/C |

MC Dom 3Ds E-Comm Secure World |

1.60% |

|

|

VISA |

Small Merchant Infinite Privilege CNP |

2.30% |

M/C |

MC Dom 3Ds E-Comm Secure We |

1.80% |

|

|

M/C |

MC Dom Emv Core |

0.72% |

M/C |

MC Dom 3Ds E-Comm Secure Muse |

1.93% |

|

|

M/C |

MC Dom Emv World |

0.95% |

M/C |

MC Dom Card Present Core Refund |

0.43% |

|

|

M/C |

MC Dom Emv World Elite |

1.22% |

M/C |

MC Dom Card Present Refund World |

0.57% |

|

|

M/C |

MC Dom Emv Muse |

1.29% |

M/C |

MC Dom Card Present Refund We |

0.73% |

|

|

M/C |

MC Dom Card Present Core |

0.95% |

M/C |

MC Dom Card Present Refund Muse |

0.77% |

|

|

M/C |

MC Dom Card Present World |

1.19% |

M/C |

MC Dom Cnp Core Refund |

0.96% |

|

|

M/C |

MC Dom Card Present World Elite |

1.45% |

M/C |

MC Dom Cnp Refund World |

1.10% |

|

|

M/C |

MC Dom Card Present Muse |

1.52% |

M/C |

MC Dom Cnp Refund World Elite |

1.24% |

|

|

M/C |

MC Dom E-Commerce Core |

1.57% |

M/C |

MC Dom Cnp Refund Muse |

1.34% |

|

|

M/C |

MC Dom E-Commerce World |

1.80% |

Interac

Effective October 1, 2024, Interac will make the following merchant category codes (MCCs) eligible for the DB QSR BAS qualification category. The interchange rate for this category is $0.02 per transaction.

|

MCC |

Merchant Category Code Description |

|

4112 |

Passenger Railways |

|

4131 |

Bus Lines |

|

5441 |

Candy, Nut, Confectionary Stores |

|

5531 |

Auto Store, Home Supply Stores |

|

5552 |

Electric Vehicle Charging |

|

5811 |

Caterers |

|

7210 |

Cleaning, Garment, and Laundry Services |

|

7211 |

Laundry Services-Family and Commercial |

|

7523 |

Automobile Parking Lots and Garages |

|

7542 |

Car Washes |

|

8050 |

Nursing and Personal Care Facilities |

|

8062 |

Hospitals |

Mastercard

- Effective October 2024, Mastercard is introducing a new Mail Order/Telephone Order (MOTO) fee in Canada. The new fee will apply to all card not present MOTO sale and refund transactions except payment transactions, wholesale travel program transactions and collection-only transactions. The fee will be 0.017% of volume cleared for both domestic and cross-border.

- Effective October 1, 2024, we will pass through fines assessed by Mastercard due to card transaction data integrity errors. This fine will be $0.025 per non-compliant transaction.

- Effective October 1, 2024, transactions you submit for processing must include the most current EMV Key for Mastercard. Please make sure your point-of-sale solution is updated with the most current software version to ensure you are passing the correct EMV Key. Businesses could be subject to a fine of up to $100 per month for each non-compliant payment solution.

We appreciate your business and are available to answer any questions you may have.

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

We wanted to make you aware that Visa, Mastercard and Interac are making several rate changes that will go into effect beginning in April 2024. These rate changes could impact your business based on your current pricing method and the types of payments that your business accepts.

Updated December 2023

Visa

Effective April 1, 2024, Visa will introduce a new fee for authorizations which use CVV2 verification. CVV2 is the 3-digit security code of the back of the card and, when sent with the authorization, is used to mitigate fraud.

|

Short Description

|

Description

|

April 2024 %

|

April 2024 Per Item

|

|

VI CVC2

|

VISA CVC2 VERIFICATION

|

0.0000%

|

$0.0028

|

Effective April 1, 2024, Visa will introduce a new fee for transactions acquired with a Visa Business Solution product.

|

Short Description |

Description |

April 2024 % |

April 2024 Per Item |

|

VICOMSOL |

VISA COMMERCIAL SOLUTIONS FEE |

0.0113% |

$0.0000 |

Effective April 1, 2024, Visa will introduce a new Integrity Risk fee for high-risk customers operating in a card not present environment. These customers have a higher risk of accepting illicit transactions when operated without controls. The high-risk categories are for MCCs 5967 (Direct Marketing) and 7273 (Dating Services).

|

Short Description |

Description |

April 2024 % |

April 2024 Per Item |

|

VI HI RISK |

VISA HIGH RISK TRANSACTION |

0.1130% |

$0.1130 |

Effective April 1, 2024, Visa will introduce a new Annual High Integrity Risk fee for high-risk customers operating in a card not present environment. These customers have a higher risk of accepting illicit transactions when operated without controls. The high-risk categories are for MCCs 5967 (Direct Marketing/Inbound), 7273 (Dating Services), 7995 (Gambling), 5122/5912 (Pharmacies/Drug Stores), 6051/6012 (Quasi-Cash/Crypto), 4816 (Computer/Network Services), 5816 (Digital Games), 6211(Securities Dealer), 5966 (Direct Marketing/Outbound), 5968 (Direct Marketing/Subscriptions) and 5993 (Tobacco Sales).

|

Short Description |

Description |

Annual Fee |

|

VIHIRSKACQ |

VISA HIGH RISK ACQUIRING FEE |

$100.00 |

Mastercard

Effective April 1, 2024, Mastercard will revise pricing of select Transaction Processing Excellence (TPE) programs from a fixed priced to a percentage with a minimum fee.

|

Short Description |

Description |

April 2024 % |

April 2024 Per Item |

|

PI UNDEF |

PROCESSING INTGRY-UNDEFINED AUTH |

0.3390% |

$0.0000 |

|

PI UNDEF M |

PROCESSING INTGRY-UNDEFINED AUTH MIN |

0.0000% |

$0.0509 |

|

PI PREATH |

PROCESSING INTGRY - PRE AUTH |

0.3390% |

$0.0000 |

|

PIPREATHMN |

PROCESSING INTGRY - PRE AUTH MIN |

0.0000% |

$0.0509 |

|

PI FRMT ER |

PROCESSING INTGRY - FORMAT ERROR |

0.3390% |

$0.0000 |

|

PIFRMTERMN |

PROCESSING INTGRY - FORMAT ERROR MIN |

0.0000% |

$0.0509 |

|

PIINVLDICA |

PROCESSING INTEGRITY INVALID ICA |

0.3390% |

$0.0000 |

|

PIIVLDICAM |

PROCESSING INTEGRITY INVALID ICA MIN |

0.0000% |

$0.0509 |

Interac

Effective April 1, 2024, Interac and Interac Flash will be decreasing the Switch Fee. The new Switch Fee will be $0.0129.

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated June 2023

Visa

Effective November 1, 2023, Visa will implement 2 new fees for Incremental and Estimated Authorizations. An Estimated Authorization is used when the Final Amount is unknown so the Merchant estimates how much the cardholder will pay. An Incremental Authorization is used when the Estimated Authorization Amount is insufficient thus the Merchant needs to increase the Total Authorized Amount.

|

Charge Type |

Short Description |

Description |

November 2023 % |

November 2023 Per Item |

|

298 |

VI INCAUTH |

VISA INCREMENTAL AUTH FEE |

0.0226% |

$0.00 |

|

299 |

VI ESTAUTH |

VISA ESTIMATED AUTH FEE |

0.0226% |

$0.00 |

Effective November 1, 2023, Visa will implement a new fee for Non-Chip Enabled Terminal Authorizations. Merchants should ensure their equipment is capable of processing Chip card transactions in order to avoid this fee.

|

Charge Type |

Short Description |

Description |

November 2023 % |

November 2023 Per Item |

|

TBD |

VI NCTERM |

VISA NONCHIP ENABLED TERMINAL |

0.00% |

$0.1695 |

Effective January 1, 2024, Visa will implement 4 new fees Misuse of Authorization and Unmatched Clearing. Misuse of Authorization occurs when an Authorization, or Partial Authorization, takes place but a matching Settled transaction or Authorization Reversal is not found. Unmatched Clearing occurs when the Settled transaction cannot be matched to a previously approved Authorization. Both fees are billed 1 month in arrears.

|

Charge Type |

Short Description |

Description |

January 2024 % |

January 2024 Per Item |

|

3145 |

VI MISUSE |

VISA MIS-USE OF AUTH |

0.00% |

$0.0565 |

|

3146 |

VI UNMATCL |

VISA UNMATCHED CLEARING |

0.00% |

$0.0565 |

|

3147 |

VIMISUSECR |

VISA MIS-USE OF AUTH CREDIT |

0.00% |

$0.0565 |

|

3148 |

VIUNMTCLCR |

VISA UNMATCHED CLEARING CREDIT |

0.00% |

$0.0565 |

Effective October 13, 2023, Visa will implement new International Interchange programs for Consumer and Commercial transactions.

|

Charge Type |

Short Description |

Description |

October 2023 % |

October 2023 Per Item |

|

TBD |

VIISPRCP |

Visa International Super Premium CP |

1.98% |

$0.00 |

|

TBD |

VIIPRCP |

Visa International Premium CP |

1.85% |

$0.00 |

|

TBD |

VIINPRCP |

Visa International Non-Premium CP |

1.10% |

$0.00 |

|

TBD |

VIIBUSCP |

Visa International Business CP |

2.00% |

$0.00 |

|

TBD |

VIICORCP |

Visa International Corporate CP |

2.00% |

$0.00 |

|

TBD |

VIIPURCP |

Visa International Purchasing CP |

2.00% |

$0.00 |

|

TBD |

VIISPRCNP |

Visa International Super Premium CNP |

1.98% |

$0.00 |

|

TBD |

VIIPRCNP |

Visa International Premium CNP |

1.85% |

$0.00 |

|

TBD |

VIINPRCNP |

Visa International Non-Premium CNP |

1.60% |

$0.00 |

|

TBD |

VIIBUSCNP |

Visa International Business CNP |

2.00% |

$0.00 |

|

TBD |

VIICORCNP |

Visa International Corporate CNP |

2.00% |

$0.00 |

|

TBD |

VIIPURCNP |

Visa International Purchasing CNP |

2.00% |

$0.00 |

|

TBD |

VIISPRDG |

Visa International Super Premium Downgrade |

2.03% |

$0.00 |

|

TBD |

VIIPRDG |

Visa International Premium Downgrade |

1.90% |

$0.00 |

|

TBD |

VIINPRDG |

Visa International Non-Premium Downgrade |

1.65% |

$0.00 |

|

TBD |

VIIBUSDG |

Visa International Business Downgrade |

2.05% |

$0.00 |

|

TBD |

VIICORDG |

Visa International Corporate Downgrade |

2.05% |

$0.00 |

|

TBD |

VIIPURDG |

Visa International Purchasing Downgrade |

2.05% |

$0.00 |

|

TBD |

VIICONCR |

Visa International Consumer Credit |

1.00% |

$0.00 |

|

TBD |

VIICOMCR |

Visa International Commercial Credit |

1.80% |

$0.00 |

Mastercard

Effective November 1, 2023, Mastercard will introduce a declined CNP Authorizations for Insufficient Funds where the receive Merchant Advice Code is 24-30 meaning to retry the transaction at a later time.

|

Charge Type |

Short Description |

Description |

November 2023 % |

November 2023 Per Item |

|

709 |

MC INSFDCL |

MC INSUFFICIENT FUNDS DECLINES |

0.00% |

$0.0226 |

Effective November 1, 2023, MasterCard will introduce new fees for MasterCard Installment Payment products.

|

Charge Type |

Short Description |

Description |

November 2023 % |

November 2023 Per Item |

|

TBD |

MC INSA |

MC INSTALLMENT - INSA |

1.695% |

$0.00 |

|

TBD |

MC INSB |

MC INSTALLMENT - INSB |

0.113% |

$0.00 |

|

TBD |

MC INSC |

MC INSTALLMENT - INSC |

0.00% |

$0.113 |

|

TBD |

MC INSA CR |

MC INSTALLMENT – INSA CR |

-1.469% |

$0.00 |

|

TBD |

MC INSB CR |

MC INSTALLMENT – INSB CR |

0.00% |

$0.00 |

|

TBD |

MC INSC CR |

MC INSTALLMENT – INSC CR |

0.00% |

$0.00 |

Effective November 1, 2023, MasterCard will introduce a new Installment Payment Interchange program and products.

|

Charge Type |

Short Description |

Description |

November 2023 % |

November 2023 Per Item |

|

TBD |

MINSTLPMTA |

MC INSTALLMENT PAYMENTS A |

1.50% |

$0.00 |

|

TBD |

MINSTLPMTB |

MC INSTALLMENT PAYMENTS B |

1.50% |

$0.00 |

|

TBD |

MINSTLPMTC |

MC INSTALLMENT PAYMENTS C |

0.00% |

$0.10 |

Effective November 1, 2023, MasterCard will introduce new B2B Products for the Wholesale Travel Interchange program.

|

Charge Type |

Short Description |

Description |

November 2023 % |

November 2023 Per Item |

|

TBD |

M B2B MTA |

MC CA DOM B2B MTA |

2.00% |

$0.00 |

|

TBD |

M B2B MTB |

MC CA DOM B2B MTB |

1.90% |

$0.00 |

|

TBD |

M B2B MTC |

MC CA DOM B2B MTC |

1.80% |

$0.00 |

|

TBD |

M B2B MTD |

MC CA DOM B2B MTD |

1.70% |

$0.00 |

|

TBD |

M B2B MTE |

MC CA DOM B2B MTE |

1.60% |

$0.00 |

|

TBD |

M B2B MTF |

MC CA DOM B2B MTF |

1.50% |

$0.00 |

|

TBD |

M B2B MTG |

MC CA DOM B2B MTG |

1.40% |

$0.00 |

|

TBD |

M B2B MTH |

MC CA DOM B2B MTH |

1.30% |

$0.00 |

|

TBD |

M B2B MTI |

MC CA DOM B2B MTI |

1.20% |

$0.00 |

|

TBD |

M B2B MTJ |

MC CA DOM B2B MTJ |

1.10% |

$0.00 |

|

TBD |

M B2B MTK |

MC CA DOM B2B MTK |

1.00% |

$0.00 |

|

TBD |

M B2B MTL |

MC CA DOM B2B MTL |

TBD |

TBD |

|

TBD |

M B2B MTM |

MC CA DOM B2B MTM |

TBD |

TBD |

|

TBD |

M B2B MTN |

MC CA DOM B2B MTN |

TBD |

TBD |

|

TBD |

M B2B MTO |

MC CA DOM B2B MTO |

TBD |

TBD |

|

TBD |

M B2B MTQ |

MC CA DOM B2B MTQ |

TBD |

TBD |

|

TBD |

M B2B MTR |

MC CA DOM B2B MTR |

TBD |

TBD |

|

TBD |

M B2B MTS |

MC CA DOM B2B MTS |

TBD |

TBD |

|

TBD |

M B2B MTT |

MC CA DOM B2B MTT |

TBD |

TBD |

|

TBD |

M B2B MTU |

MC CA DOM B2B MTU |

TBD |

TBD |

|

TBD |

M B2B MTV |

MC CA DOM B2B MTV |

TBD |

TBD |

|

TBD |

M I B2BMTA |

MC CA INTL B2B MTA |

2.00% |

$0.00 |

|

TBD |

M I B2BMTB |

MC CA INTL B2B MTB |

1.90% |

$0.00 |

|

TBD |

M I B2BMTC |

MC CA INTL B2B MTC |

1.80% |

$0.00 |

|

TBD |

M I B2BMTD |

MC CA INTL B2B MTD |

1.70% |

$0.00 |

|

TBD |

M I B2BMTE |

MC CA INTL B2B MTE |

1.60% |

$0.00 |

|

TBD |

M I B2BMTF |

MC CA INTL B2B MTF |

1.50% |

$0.00 |

|

TBD |

M I B2BMTG |

MC CA INTL B2B MTG |

1.40% |

$0.00 |

|

TBD |

M I B2BMTH |

MC CA INTL B2B MTH |

1.30% |

$0.00 |

|

TBD |

M I B2BMTI |

MC CA INTL B2B MTI |

1.20% |

$0.00 |

|

TBD |

M I B2BMTJ |

MC CA INTL B2B MTJ |

1.10% |

$0.00 |

|

TBD |

M I B2BMTK |

MC CA INTL B2B MTK |

1.00% |

$0.00 |

|

TBD |

M I B2BMTL |

MC CA INTL B2B MTL |

TBD |

TBD |

|

TBD |

M I B2BMTM |

MC CA INTL B2B MTM |

TBD |

TBD |

|

TBD |

M I B2BMTN |

MC CA INTL B2B MTN |

TBD |

TBD |

|

TBD |

M I B2BMTO |

MC CA INTL B2B MTO |

TBD |

TBD |

|

TBD |

M I B2BMTQ |

MC CA INTL B2B MTQ |

TBD |

TBD |

|

TBD |

M I B2BMTR |

MC CA INTL B2B MTR |

TBD |

TBD |

|

TBD |

M I B2BMTS |

MC CA INTL B2B MTS |

TBD |

TBD |

|

TBD |

M I B2BMTT |

MC CA INTL B2B MTT |

TBD |

TBD |

|

TBD |

M I B2BMTU |

MC CA INTL B2B MTU |

TBD |

TBD |

|

TBD |

M I B2BMTV |

MC CA INTL B2B MTV |

TBD |

TBD |

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated December 2022

Visa

Effective April 1, 2023, Visa will implement a new fee when account verification is required prior to authorization:

- Domestic Account Verification: $0.0113

- International Account Verification: $0.0226

Mastercard

Effective April 1, 2023, Mastercard will introduce a Digital Enablement fee on all authorizations. The minimum fee will be $0.0226 and the maximum fee will be $0.2260.

|

Charge Type |

Short Description |

Description |

April 2023 % |

April 2023 Per Item |

|

745 |

MC ACQ DIG |

MC DIGITAL |

0.0226% |

$0.00 |

|

743 |

MCAQDIGMIN |

MC DIGITAL MIN |

0% |

$0.0226 |

|

744 |

MCAQDIGMAX |

MC DIGITAL MAX |

0% |

$0.226 |

Effective April 1, 2023, Mastercard will increase its Excessive Authorization Attempt fee to $0.565. This fee is assessed when 10 or more declines occur on the same card and card acceptor within a 24-hour period.

Effective May 1, 2023, Mastercard will increase its Intracountry Consumer Contactless interchange to match the level of Card Present EMV. The new Intracountry Consumer Contactless interchange rates will change as follows:

|

Charge Type |

Description |

Short Description |

Current Rate |

May 2023 Rate |

|

22008 |

MC Dom Paypass Core |

M PYPASS C |

0.87% |

0.92% |

|

22019 |

MC Dom Paypass World |

M PYPASS W |

1.16% |

1.22% |

|

22030 |

MC Dom Paypass World Elite |

M PYPSS WE |

1.48% |

1.56% |

|

22041 |

MC Dom Paypass Muse |

M PYPSS M |

1.57% |

1.65% |

Interac

Effective April 1, 2023, Interac will increase its Switch Fee to $0.0145.

Effective April 1, 2023, the Interac Switch Fee and Flash Interchange will be passed through to you at cost.

American Express

Effective April 1, 2023, American Express will increase its International Assessment Fee rate to 0.678%.

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated July 2022

Visa

Effective November 1, 2022, Visa will expand its B2B Virtual Payments Program to include additional customer types. Details on the new merchant category codes (MCC) and rates can be found in Table 1 and Table 2 below.

TABLE 1

|

MCC |

Description |

MCC |

Description |

|

4111 |

COMMUTER TRANS/FERRY |

5992 |

FLORIST |

|

4121 |

TAXICAB LIMOUSINE |

7832 |

MOVIE THEATRE |

|

4789 |

MISC TRANSPORTATION |

7922 |

TICKET AGENCY |

|

5812 |

RESTAURANT |

7992 |

PUBLIC GOLF COURSE |

|

5813 |

BAR NIGHTCLUBS |

9399 |

GOVERNMENT SERVICES |

|

5814 |

FAST FOOD RESTAURANT |

TABLE 2

|

Description |

Rate |

|

B2B Program 1 |

0.80% |

|

B2B Program 2 |

1.00% |

|

B2B Program 3 |

1.20% |

|

B2B Program 4 |

1.40% |

|

B2B Program 5 |

1.60% |

|

B2B Program 6 |

1.80% |

|

B2B Program 8 |

0.90% |

|

B2B Program 9 |

1.10% |

|

B2B Program 10 |

1.30% |

|

B2B Program 11 |

1.50% |

|

B2B Program 12 |

1.70% |

|

B2B Program 13 |

1.90% |

Effective November 1, 2022, Visa will implement new Consumer Bill Payment Service rates. These rates will match current rates for existing Emerging Market categories, and are summarized below in Table 3.

TABLE 3

|

Visa Interchange Category |

Shrt Desc |

% Rate |

|

Consumer Bill Payment Chip Standard - Cons |

CBPSCHIPSTD |

0.98% |

|

Consumer Bill Payment Chip Standard - Inft |

CBPSCPSTDINF |

1.17% |

|

Consumer Bill Payment Chip Standard - Bus |

CBPSCPSTDBUS |

1.80% |

|

Consumer Bill Payment Chip Stand - Prepaid |

CBPSCHPSTDPP |

0.98% |

|

Consumer Bill Payment Chip Stand - Comm Prepaid |

CBPSCHSTDCPP |

1.80% |

|

Consumer Bill Payment Standard - Cons |

CBPSSTDCON |

0.98% |

|

Consumer Bill Payment Preferred Cons |

CBPSPREFCON |

0.80% |

|

Consumer Bill Payment Standard - Inft |

CBPSSTDINF |

1.17% |

|

Consumer Bill Payment Preferred Inf |

CBPSPREFINF |

1.00% |

|

Consumer Bill Payment Standard - Bus |

CBPSSTDBUS |

1.80% |

|

Consumer Bill Payment Standard - Prepaid |

CBPSSTDPP |

0.98% |

|

Consumer Bill Payment Standard - Comm Prepaid |

CBPSSTDCPP |

1.80% |

|

Consumer Bill Payment STANDARD INF PRVLG |

CBPSSTDIP |

1.95% |

|

Consumer Bill Payment Preferred Infprv |

CBPSPREFIP |

1.95% |

|

CHIP Consumer Bill Payment STND INF PRVLG |

CBPSCHPSTDIP |

1.95% |

Effective November 1, 2022, Visa will introduce the following assessments:

- Acquirer INTL Settlement Charge of 0.2825%, to be assessed when the currency accepted is different than Canadian dollars. This will apply to any dynamic or multi-currency program.

- Acquirer Multi-Currency Settlement Charge of 0.1130%, to be assessed when the settlement currency is not Canadian dollars.

- CBPS Settlement Charge of $0.1130, to be assessed on Visa Bill Pay transactions

- Address Verification Service fee of $0.00113, to be assessed when Address Verification is not captured during the transaction

Mastercard

Effective November 1, 2022, we’ll begin passing through a $0.0226 assessment on transactions that generate a decline.

Interac

Effective November 1, 2022, Interac will introduce a new pricing tier for Interac Debit Contactless (Interac Flash) transactions. Contactless Interac transactions greater than $100 will receive a new flat fee of $0.055.

Interac Contactless Payment Interchange Pricing Structure

|

Transaction Tier |

Flat-fee Per Transaction |

|

Transaction from $0.01 to $100.00 |

$0.035 |

|

Transaction from $100.01 to $250.00 |

$0.055 |

American Express

Effective November 1, 2022, American Express will introduce new interchange categories. Details are below in Table 4.

TABLE 4

|

New Interchange Category |

% Rate |

Per Item |

Volume Tier |

|

AMEX CA EMERGING MARKET |

1.18% |

$0.00 |

N/A |

|

AMEX CA RESIDENTIAL RENT |

1.08% |

$0.00 |

N/A |

|

AMEX CA UTILITY Tier 1 |

0% |

$0.68 |

<=1000 |

|

AMEX CA UTILITY Tier 2 |

1.88% |

$0.00 |

>1000 |

Effective November 1, 2022, American Express will remove the current volume tiers for its OptBlue healthcare program and update the existing rate structure. Details are below in Table 5.

TABLE 5

|

Description |

Short Description |

CGT |

Rate |

|

AMEX CA HEALTHCARE 1 CP |

A HLTH 1CP |

10516 |

1.34% |

|

AMEX CA HEALTHCARE 2 CP |

A HLTH 2CP |

10517 |

1.34% |

|

AMEX CA HEALTHCARE 1 CNP |

A HLTH1CNP |

10518 |

1.34% |

|

AMEX CA HEALTHCARE 2 CNP |

A HLTH2CNP |

10519 |

1.34% |

Effective November 1, 2022, several business types will see an update to their interchange category. Details are below in Table 6.

TABLE 6

|

MCC |

Desc |

Current Category |

November 2022 Category |

|

5960 |

DIRECT MARKETING-INSURANCE SER |

B2B/Wholesale |

Emerging Market |

|

6300 |

INSURANCE SALES |

B2B/Wholesale |

Emerging Market |

|

7032 |

RECREATION CAMP |

Other |

Emerging Market |

|

7911 |

DANCE HALL SCHOOL |

Services |

Emerging Market |

|

8211 |

SCHOOL |

Other |

Emerging Market |

|

8220 |

COLLEGE UNIVERSITY |

Other |

Emerging Market |

|

8241 |

CORRESPONDENCE SCHOOL |

Other |

Emerging Market |

|

8244 |

SECRETARIAL SCHOOL |

Other |

Emerging Market |

|

8249 |

TRADE VOCATION SCHOOL |

Other |

Emerging Market |

|

8299 |

EDUCATIONAL SERVICE |

Other |

Emerging Market |

|

8351 |

CHILD CARE SERVICES |

Other |

Emerging Market |

|

9211 |

COURT COSTS |

Other |

Emerging Market |

|

9222 |

FINES |

Other |

Emerging Market |

|

9311 |

TAX PAYMENTS |

Other |

Emerging Market |

|

9399 |

GOVERNMENT SERVICES |

Other |

Emerging Market |

|

8050 |

NURSING PERSONAL CARE |

Healthcare |

Residential Rent |

|

4111 |

COMMUTER TRANS/FERRY |

Other |

Emerging Market |

|

4112 |

PASSENGER RAILWAYS |

Other |

Emerging Market |

|

4131 |

BUS LINE |

Other |

Emerging Market |

|

4784 |

TOLL BRIDGE FEE |

Other |

Emerging Market |

|

6513 |

REAL ESTATE AGENTS AND MANAGERS, RENTALS |

Other |

Residential Rent |

|

8398 |

CHARITABLE ORG |

Other |

Emerging Market |

|

742 |

VETERINARY SERVICE |

Services |

Healthcare |

|

4119 |

AMBULANCE SERVICE |

Services |

Healthcare |

|

4900 |

PUBLIC UTILITY |

Services |

Utilities |

|

7523 |

PARKING LOT GARAGE |

Services |

Emerging Market |

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated June 2022

Visa

Visa will modify interchange rates for the large ticket and Straight Through Processing (STP) interchange programs. Effective for October 2022, Visa will implement modifications to the structure, rates and qualification criteria of programs that support its large ticket and STP platforms.

Visa’s large ticket interchange program was introduced in 2015 to address opportunities in B2B payments at larger transaction sizes. Visa will modify this program by adjusting the eligible transaction size and incentive rate levels. Additionally, Visa will remove the large ticket interchange rates from the STP service; these transactions will now qualify for the applicable corporate and purchasing rates.

New Large Ticket Program Criteria

· Must be a Visa Corporate, Purchasing, or Fleet Card

· Must meet Canadian domestic fee jurisdiction

· Large Ticket Tier 1 for transaction amounts CA$100,000 to CA$249,999.99

· Large Ticket Tier 2 for transaction amounts CA$250,000 or greater

Discontinued Categories

|

Visa Interchange Category (October 2022) |

% Rate |

|

CA Straight Through Process TR1 |

2.00% |

|

CA Straight Through Process TR2 |

1.30% |

|

CA Straight Through Process TR3 |

1.20% |

|

CA Straight Through Process TR4 |

1.10% |

New Categories

|

Visa Interchange Category (October 2022) |

% Rate |

|

Large Ticket Tier 1 |

1.30% |

|

Large Ticket Tier 2 |

1.00% |

We wanted to make you aware that the card brands (Visa, Mastercard, Interac) are making several rate changes that will go into effect in April and May 2022. These rate changes could impact your business based on your current pricing method and the types of payments that your business accepts.

Visa

Effective April 22, 2022, Visa will introduce the following new interchange programs for consumer credit cards:

• New card-not-present fee programs for tokenized transactions.

• New recurring payment fee programs for tokenized transactions.

|

Description |

Rate |

|

Visa Token CNP Infinite Privilege |

2.35% |

|

Visa Token CNP Infinite Privilege INTL |

2.35% |

|

Visa Token CNP Infinite |

1.60% |

|

Visa Token CNP Infinite INTL |

1.60% |

|

Visa Token CNP Consumer |

1.35% |

|

Visa Token CNP Consumer INTL |

1.35% |

|

Description |

Rate |

|

Visa Recurring Payment - Infinite Privilege |

1.90% |

|

Visa Recurring Payment - Infinite Privilege INTL |

1.90% |

|

Visa Recurring Payment - Infinite |

1.48% |

|

Visa Recurring Payment - Infinite INTL |

1.48% |

|

Visa Recurring Payment Consumer |

1.20% |

|

Visa Recurring Payment Consumer INTL |

1.20% |

Effective April 1, 2022, Visa will introduce the following new assessment fee programs for Visa credit cards:

• New data integrity fees for cards that receive more than 15 attempted transactions within a rolling 30-day period, including automated authorizations such as recurring payment transactions.

• New data integrity fees for a subset of declined transaction codes including, but not limited to, lost, stolen, or restricted cards.

|

Description |

Rate |

|

Per Item |

|

VISA INTEG EXCESS REATTEMPTS |

0.00% |

+ |

$ 0.1130 |

|

VISA INTEG EXCESS REATTEMPTS INT |

0.00% |

+ |

$ 0.1695 |

|

VISA INTEG NEVER REAPPROVE FEE |

0.00% |

+ |

$ 0.1130 |

|

VISA INTEG NEVER REAPPROVE INTL |

0.00% |

+ |

$ 0.1695 |

Effective April 1, 2022, Visa will apply a new authorization fee of $0.0011 for keyed Visa transactions with an address verification (AVS) request.

Effective April 1, 2022, Visa will update the interchange rates for the categories listed below:

|

Description |

Rate |

|

Supermarket Chip – Infinite Privilege |

1.95% |

|

Supermarket Electronic-Infinite Privilege |

1.95% |

|

Visa Chip Everyday Needs Infinite Privilege |

1.95% |

|

Visa Everyday Needs Infinite Privilege |

1.95% |

|

Visa Chip Restaurant Infinite Privilege |

1.95% |

|

Visa Restaurant Infinite Privilege |

1.95% |

|

Chip Electronic – Prepaid Cons |

1.42% |

|

Non-Chip Elect -- Prepaid Cons |

1.42% |

|

Chip Standard – Prepaid Cons |

1.52% |

|

Standard – Prepaid Consumer |

1.52% |

|

Recurring Payment – Prepaid Cons |

1.37% |

|

Service Station Chip – PPD Cons |

1.18% |

|

Srvc Station Electronic-PPD Cons |

1.18% |

|

Supermarket Chip – Prepaid Cons |

1.23% |

|

Supermarket Electronic-PPD Cons |

1.23% |

|

Visa Chip Everyday Needs Prepaid |

1.36% |

|

Visa Card not Present Prepaid |

1.52% |

Mastercard

Effective May 1, 2022, Mastercard will apply a new Transaction Processing Excellence Assessment Fee of $0.0339 for excessive authorization declines on cards that have been closed or cancelled by Mastercard.

Effective April 22, 2022, Mastercard is restructuring its Consumer International interchange categories. Specifically, Mastercard will be adding new and eliminating existing categories.

|

Description |

Current Rate |

New Rate |

|

MC INTL CAD CP CORE 1 |

New Category |

1.10% |

|

MC INTL CAD CP S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD CP PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD E-COMM CORE 1 |

New Category |

1.60% |

|

MC INTL CAD E-COMM S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD E-COMM PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD E-COMM CORE 1 |

New Category |

1.60% |

|

MC INTL CAD E-COMM S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD E-COMM PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD CP CORE 1 |

1.10% |

1.10% |

|

MC INTL CAD STANDARD CORE 1 |

New Category |

1.60% |

|

MC INTL CAD STANDARD S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD STANDARD PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD CP CORE 1 |

New Category |

1.10% |

|

MC INTL CAD STANDARD CORE 1 |

New Category |

1.60% |

|

MC INTL CAD CR VOUCHER CORE |

1.00% |

1.00% |

|

MC INTL CAD CR VOUCHER S PREM |

New Category |

1.00% |

|

MC INTL CAD CR VOUCHER PREMIUM |

New Category |

1.00% |

|

MC INTL CAD CR VOUCHER CORE |

1.00% |

1.00% |

|

MC INTL CAD CP PREMIUM 1 |

New Category |

1.85% |

|

MC INTL CAD CP S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD CP CORE 1 |

1.10% |

1.10% |

|

MC INTL CAD CP PREMIUM 1 |

New Category |

1.85% |

|

MC INTL CAD E-COMM PREMIUM 1 |

New Category |

1.85% |

|

MC INTL CAD E-COMM S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD E-COMM CORE 1 |

1.54% |

1.60% |

|

MC INTL CAD E-COMM PREMIUM 1 |

New Category |

1.85% |

|

MC INTL CAD E-COMM S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD E-COMM CORE 1 |

1.44% |

1.60% |

|

MC INTL CAD STANDARD PREMIUM 1 |

New Category |

1.85% |

|

MC INTL CAD STANDARD S PREMIUM 1 |

1.98% |

1.98% |

|

MC INTL CAD STANDARD CORE 1 |

1.60% |

1.60% |

|

MC INTL CAD STANDARD S PREMIUM 1 |

New Category |

1.98% |

|

MC INTL CAD STANDARD PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD STANDARD CORE 1 |

1.60% |

1.60% |

|

MC INTL CAD E-COMM S PREMIUM 1 |

New Category |

1.98% |

|

MC INTL CAD E-COMM PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD E-COMM CORE 1 |

1.44% |

1.60% |

|

MC INTL CAD E-COMM S PREMIUM 1 |

New Category |

1.98% |

|

MC INTL CAD E-COMM PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD E-COMM CORE 1 |

1.54% |

1.60% |

|

MC INTL CAD CP S PREMIUM 1 |

New Category |

1.98% |

|

MC INTL CAD CP PREMIUM 1 |

1.85% |

1.85% |

|

MC INTL CAD CP CORE 1 |

1.10% |

1.10% |

|

MC INTL CAD STANDARD PREMIUM 1 |

New Category |

1.85% |

Interac

Effective April 1, 2022, the Interac Switch Fee assessment will increase from $0.0101 to $0.0107.

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay, and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated June 2021

Visa

Effective October 2021, Visa will reduce the interchange rates for the categories listed below:

|

Interchange Category |

Current Rate |

New Rate |

|

Supermarket Chip – Consumer |

1.00% |

0.95% |

|

Supermarket Chip – Infinite |

1.20% |

1.15% |

|

Supermarket Chip – Infinite Privilege |

1.95% |

1.15% |

|

Supermarket Electronic-Consumer |

1.00% |

0.95% |

|

Supermarket Electronic-Infinite |

1.20% |

1.15% |

|

Supermarket Electronic-Infinite Privilege |

1.95% |

1.15% |

|

Visa Chip Everyday Needs Consumer |

1.20% |

1.10% |

|

Visa Chip Everyday Needs Infinite |

1.30% |

1.20% |

|

Visa Chip Everyday Needs Infinite Privilege |

1.95% |

1.20% |

|

Visa Everyday Needs Consumer |

1.20% |

1.10% |

|

Visa Everyday Needs Infinite |

1.30% |

1.20% |

|

Visa Everyday Needs Infinite Privilege |

1.95% |

1.20% |

|

Visa Chip Restaurant Consumer |

1.20% |

1.10% |

|

Visa Chip Restaurant Infinite |

1.30% |

1.20% |

|

Visa Chip Restaurant Infinite Privilege |

1.95% |

1.20% |

|

Visa Restaurant Consumer |

1.20% |

1.10% |

|

Visa Restaurant Infinite |

1.30% |

1.20% |

|

Visa Restaurant Infinite Privilege |

1.95% |

1.20% |

Mastercard

Effective October 2021, Mastercard will adjust the rates for the interchange categories listed below:

|

Mastercard Interchange Category |

Current Rate |

Current Per Item |

New Rate |

New Per item |

|

International Electronic |

1.10% |

$0.000 |

Eliminated |

|

|

International Merchant UCAF |

1.44% |

$0.000 |

Eliminated |

|

|

International Full UCAF |

1.54% |

$0.000 |

Eliminated |

|

|

International Standard |

1.60% |

$0.000 |

Eliminated |

|

|

MC Intl Chip Electronic |

1.10% |

$0.000 |

Eliminated |

|

|

MC Intl Chip Standard |

1.60% |

$0.000 |

Eliminated |

|

|

MC Intl Cons Cv Super Premium |

1.00% |

$0.000 |

Eliminated |

|

|

MC ITL CONSUMER CV PREMIUM |

1.00% |

$0.000 |

Eliminated |

|

|

Intl Electronic Premium |

1.85% |

$0.000 |

Eliminated |

|

|

MC Intl Chip Electronic Prem |

1.85% |

$0.000 |

Eliminated |

|

|

Intl Full UCAF Premium |

1.85% |

$0.000 |

Eliminated |

|

|

Intl Merchant UCAF Premium |

1.85% |

$0.000 |

Eliminated |

|

|

Intl Cons Standard Premium |

1.85% |

$0.000 |

Eliminated |

|

|

MC Intl Super Premium Standard |

1.98% |

$0.000 |

Eliminated |

|

|

MC Intl Super Premium Merch Ucaf |

1.98% |

$0.000 |

Eliminated |

|

|

MC Intl Super Premium Full Ucaf |

1.98% |

$0.000 |

Eliminated |

|

|

MC Intl Super Premium Electronic |

1.98% |

$0.000 |

Eliminated |

|

|

MC Intl Chip Standard Prem |

1.85% |

$0.000 |

Eliminated |

|

|

INTL Rate I Digital Commerce Core |

|

|

1.60% |

$0.000 |

|

INTL Rate I Digital Commerce Premium |

|

|

1.85% |

$0.000 |

|

INTL Rate I Digital Commerce Super Premium |

|

|

1.98% |

$0.000 |

|

INTL Rate II Card Present Core |

|

|

1.10% |

$0.000 |

|

INTL Rate II Card Present Premium |

|

|

1.85% |

$0.000 |

|

INTL Rate II Card Present Super Premium |

|

|

1.98% |

$0.000 |

|

INTL Rate III Standard Core |

|

|

1.60% |

$0.000 |

|

INTL Rate III Standard Premium |

|

|

1.85% |

$0.000 |

|

INTL Rate III Standard Super Premium |

|

|

1.98% |

$0.000 |

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

Updated April 2021

Mastercard

Effective August 1, 2021, Mastercard will reduce Standard and e-commerce consumer card categories. Details of the specific reductions are as follows

|

Current Interchange Rate |

New Interchange Rate |

|

|

April 2021 |

August 2021 |

|

|

Mastercard Interchange Category |

% Rate |

% Rate |

|

MC Dom E-Commerce World |

2.00% |

1.90% |

|

MC Dom E-Commerce Core |

1.76% |

1.67% |

|

MC Dom E-Commerce Muse |

2.39% |

2.25% |

|

MC Dom E-Commerce World Elite |

2.24% |

2.13% |

|

MC Dom Standard World |

2.30% |

2.19% |

|

MC Dom Standard Core |

2.06% |

1.96% |

|

MC Dom Standard Muse |

2.69% |

2.54% |

|

MC Dom Standard World Elite |

2.54% |

2.42% |

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay and Visa continuously update their interchange rate and fee structures for specific categories. We will regularly communicate these updates on this page.

UPDATED DECEMBER 2020

Interac

Effective April 1, 2021, the Interac Switch Fee assessment will increase from $0.0096 to $0.0101.

Discover

Effective April 1, 2021, the Discover Network Authorization Fee will increase from $0 to $0.0214.

Effective April 1, 2021, Discover will be implementing the following changes to domestic interchange rates.

|

Interchange Rate |

Interchange Rate |

|||

|

October 2020 |

April 2021 |

|||

|

Discover Interchange Category |

Shrt Desc |

Chg Type |

% Rate |

% Rate |

|

Disc Can Dom Recurring Rewards |

RECURE R |

2717 |

1.45% |

1.15% |

|

Disc Can Dom Supermarket Rewards |

SPRMRKT R |

2718 |

1.42% |

1.00% |

|

Disc Can Dom Petroleum Rewards |

PETROL R |

2719 |

1.27% |

1.00% |

|

Disc Can Dom Retail Rewards |

RETAIL R |

2720 |

1.60% |

1.15% |

|

Disc Can Dom Base Rewards |

BASE R |

2723 |

1.72% |

1.55% |

|

Disc Can Dom Recurring Premium |

RECURE P |

2727 |

1.70% |

1.30% |

|

Disc Can Dom Supermarket Premium |

SPRMRKT P |

2728 |

1.65% |

1.22% |

|

Disc Can Dom Petroleum Premium |

PETROL P |

2729 |

1.50% |

1.25% |

|

Disc Can Dom Retail Premium |

RETAIL P |

2730 |

1.98% |

1.30% |

|

Disc Can Dom Base Premium |

BASE P |

2733 |

2.10% |

1.82% |

|

Disc Can Dom Recurring Prem Plus |

RECURE PP |

2737 |

2.10% |

1.70% |

|

Disc Can Dom Supermrkt PremPlus |

SPRMRKT PP |

2738 |

2.00% |

1.64% |

|

Disc Can Dom Petroleum Prem Plus |

PETROL PP |

2739 |

2.00% |

1.64% |

|

Disc Can Dom Retail Prem Plus |

RETAIL PP |

2740 |

2.25% |

1.75% |

|

Disc Can Dom Base Prem Plus |

BASE PP |

2743 |

2.60% |

2.35% |

|

Disc Can Dom Recurring Debit |

RECURE D |

2747 |

1.20% |

0.45% |

|

Disc Can Dom Supermrkt Debit |

SPRMRKT D |

2748 |

1.20% |

0.35% |

|

Disc Can Dom Petroleum Debit |

PETROL D |

2749 |

1.20% |

0.35% |

|

Disc Can Dom Retail Debit |

RETAIL D |

2750 |

1.20% |

0.45% |

|

Disc Can Dom Base Debit |

BASE D |

2753 |

1.20% |

1.15% |

|

Disc Can Dom Recurring Prepaid |

RECURE PD |

2757 |

1.49% |

1.40% |

|

Disc Can Dom Supermrkt Prepaid |

SPRMRKT PD |

2758 |

1.49% |

1.43% |

|

Disc Can Dom Petroleum Prepaid |

PETROL PD |

2759 |

1.49% |

1.20% |

|

Disc Can Dom Retail Prepaid |

RETAIL PD |

2760 |

1.49% |

1.43% |

|

Disc Can Dom Base Prepaid |

BASE PD |

2763 |

1.49% |

1.55% |

|

Disc Can Dom Recurring Comm |

RECURECOM |

2767 |

2.20% |

2.00% |

|

Disc Can Dom Supermarket Comm |

SPRMRKTCOM |

2768 |

2.15% |

2.00% |

|

Disc Can Dom Petroleum Comm |

PETROLCOM |

2769 |

2.15% |

2.00% |

|

Disc Can Dom Retail Comm |

RETAILCOM |

2770 |

2.25% |

2.00% |

|

Disc Can Dom Base Comm |

BASE COM |

2773 |

2.65% |

2.00% |

|

Disc Can Dom Credit Vchr1 Debit |

CR VCHR1 D |

2754 |

1.20% |

1.10% |

|

Disc Can Dom Cr Vchr1 Prepaid |

CR VCHR1PD |

2764 |

1.49% |

1.58% |

|

Disc Can Dom Credit Vchr1 Rewards |

CR VCHR1 R |

2724 |

1.72% |

1.58% |

|

Disc Can Dom Cr Vchr1 Premium |

CR VCHR1 P |

2734 |

2.10% |

1.85% |

|

Disc Can Dom Cr Vchr1 Prem Plus |

CR VCHR1PP |

2744 |

2.60% |

2.49% |

|

Disc Can Dom Credit Vchr1 Comm |

CRVCHR1COM |

2774 |

2.65% |

2.00% |

|

Disc Can Dom Credit Vchr3 Debit |

CR VCHR3 D |

2756 |

1.20% |

1.15% |

|

Disc Can Dom Cr Vchr3 Prepaid |

CR VCHR3PD |

2766 |

1.49% |

1.32% |

|

Disc Can Dom Credit Vchr3 Rewards |

CR VCHR3 R |

2726 |

1.42% |

1.32% |

|

Disc Can Dom Cr Vchr3 Premium |

CR VCHR3 P |

2736 |

1.65% |

1.45% |

|

Disc Can Dom Cr Vchr3 Prem Plus |

CR VCHR3PP |

2746 |

2.00% |

1.96% |

|

Disc Can Dom Credit Vchr3 Comm |

CRVCHR3COM |

2776 |

2.15% |

2.00% |

Visa

Effective April 16, 2021, Visa will introduce new fees for data consistency and for excess re-attempts of transactions. Customers that re-attempt an authorization 15 times or more within a 30-day period, or that attempt a key-entered transaction with no Electronic Commerce Indicator (ECI) will be subject to the following fees:

$0.10 per attempt on a domestic transaction

$0.15 per attempt on a cross-border transaction

Effective April 16, 2020, the Visa International Acquirer Service Fee will increase for both Canadian currency and issuer (home) currency transactions based on the following:

|

Assessment Category |

Shrt Desc |

Chg Type |

Current Rate |

New Rate |

|

Int'l Acq Service Fee |

V IASF |

217 |

0.4520% |

0.6780% |

|

Int'l Acq Service Fee - Issuer Currency |

V IASF ISS |

218 |

0.9040% |

1.1300% |

|

Int'l Cash Advance Acq Service Fee |

CA IASF |

219 |

0.4520% |

0.6780% |

|

Int'l Cash Acq Service Fee - Issuer Currency |

CA IASFISS |

220 |

0.4520% |

1.1300% |

|

INTL ACQ SERVICE CNP FEE ISSUE |

V IASF CNP |

188 |

0.9605% |

1.1300% |

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay and Visa continuously update their fee structures for specific categories. We will regularly communicate these updates on this page.

Updated December 2019

Interac

Effective April 1, 2020

- Switch fee assessment increases from $0.00904 to $0.009605

Mastercard

Effective May 1, 2020

- Effective October 18, 2019, Mastercard will update its interchange rate for international refund/return transactions to:

- 1.00% for transactions with consumer product codes

- 1.80% for transactions with commercial product codes

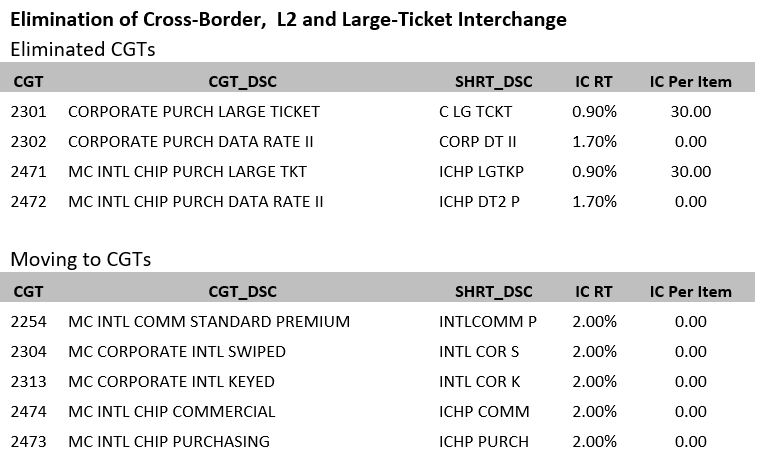

- Effective October 19, 2019, Mastercard will eliminate its Cross-Border, L2 and Large Ticket interchange categories. A summary of the eliminated charge types and the new charge types is available on the back side of this letter

- Effective November 1, 2019, Mastercard will begin including credit transactions (e.g. refunds, returns) into its calculation of the Current Volume Assessment in Canada.

- Effective November 4, 2019, Mastercard will introduce a Pre-Authorization Fee in Canada. A 0.05% fee will be added to authorizations that meet all of these conditions:

- The authorization is processed through the Mastercard Network;

- The authorization request is either fully or partially approved;

- The authorization is coded as a pre-authorization; and

- The authorization originates from a Canadian merchant account.

- Introduction of International Super Premium Categories in Canada:

- IRD EE—Interregional Consumer Super Premium Electronic

- IRD EF—Interregional Consumer Super Premium Full UCAF

- IRD EM—Interregional Consumer Super Premium Merchant UCAF

- IRD ES—Interregional Consumer Super Premium Standard

- These will include the following products (GCMS Product ID): MCW, MWE, MDH, MDW, MNW, MUW, MWD, MWR, TCW, TNW, TWB, WBE, MBW, MBK, MWP, WPD, MFB, MFE, MSP. These will be defined as Commercial Non-Qual for tiered merchants

- Revised Interchange Programs in Canada:

- Restructure of the Consumer Credit interchange programs. Complete replacement of prior program (including removal of the CFIB rates) with new structure. This includes 10 Interchange Categories and 4 card types. Muse is a new super premium card type being introduced for the first time. For tiered programs, Muse will be classified in the Commercial Non-Qual bucket. New and Revised Intracountry Interchange Programs:

- Revised interchange categories and rates on commercial programs

Effective May 4th, 2020

- Fixed Acquirer Access Fee change from 0.008% to $0.0103 per transaction

Visa

Effective April 1, 2020

- International Acquirer Service Assessment Fee increases for both Canadian currency and Issuer (home) currency transactions

Effective April 18, 2020

- Reductions to Domestic Consumer Interchange Rates. Visa is introducing numerous rate changes to its existing interchange categories

- Modifications to Interchange Categories:

- Introduction of 3 new categories: Performance Program—CNP, Industry Program—Utilities (removed from Tier 1), Emerging Segments—Preferred

- Elimination of 1 category (Performance Program—Tier 2)

- Changes to Emerging Segment: removal of Electronic and Recurring, addition of Card Not Present to qualification criteria

Visa Domestic Interchange Rates

Card brands including American Express, Discover, Interac, JCB, Mastercard, Union Pay and Visa continuously update their fee structures for specific categories. We will regularly communicate these updates on this page.

Updated June 2019

Visa

Effective October 18, 2019, the Merchant Category Code (MCC) 8661 – Religious Organizations – will be added to Visa’s Emerging Rate program. Emerging segment rates (which are lower than standard rates) will be available for transactions processed with this MCC.

Mastercard

- Effective October 18, 2019, Mastercard will update its interchange rate for international refund/return transactions to:

- 1.00% for transactions with consumer product codes

- 1.80% for transactions with commercial product codes

- Effective October 19, 2019, Mastercard will eliminate its Cross-Border, L2 and Large Ticket interchange categories. A summary of the eliminated charge types and the new charge types is available on the back side of this letter

- Effective November 1, 2019, Mastercard will begin including credit transactions (e.g. refunds, returns) into its calculation of the Current Volume Assessment in Canada.

- Effective November 4, 2019, Mastercard will introduce a Pre-Authorization Fee in Canada. A 0.05% fee will be added to authorizations that meet all of these conditions:

- The authorization is processed through the Mastercard Network;

- The authorization request is either fully or partially approved;

- The authorization is coded as a pre-authorization; and

- The authorization originates from a Canadian merchant account.