CREDIT CARD SURCHARGING

Keep more money in your pocket by passing on the fees

.png?width=803&name=Group%203531%20(2).png)

Saving on fees = more opportunities

to grow your business

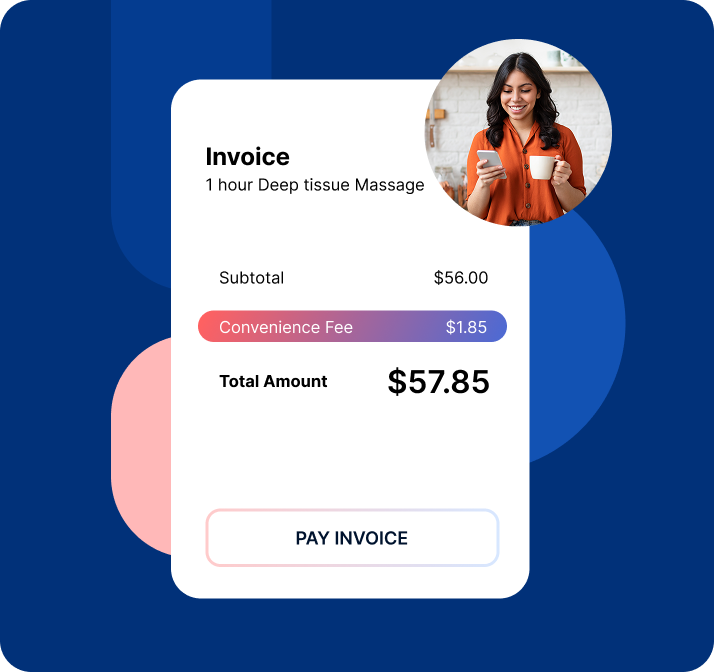

Credit Card Surcharging

When a person uses a credit card over debit

You Pay

0%

CUSTOMER PAYS

2.4%

Maximize your Margins

Offset credit card fees by passing them to customers who choose to pay with credit — and hold onto more of your hard-earned revenue.

Empower Customer Choice

Let customers decide what works best for them. Credit card users cover the fee, while others pay the standard price — no surprises.

Keep Your Prices Competitive

Avoid blanket price increases. Surcharging helps you keep your listed prices sharp while protecting your profits behind the scenes.

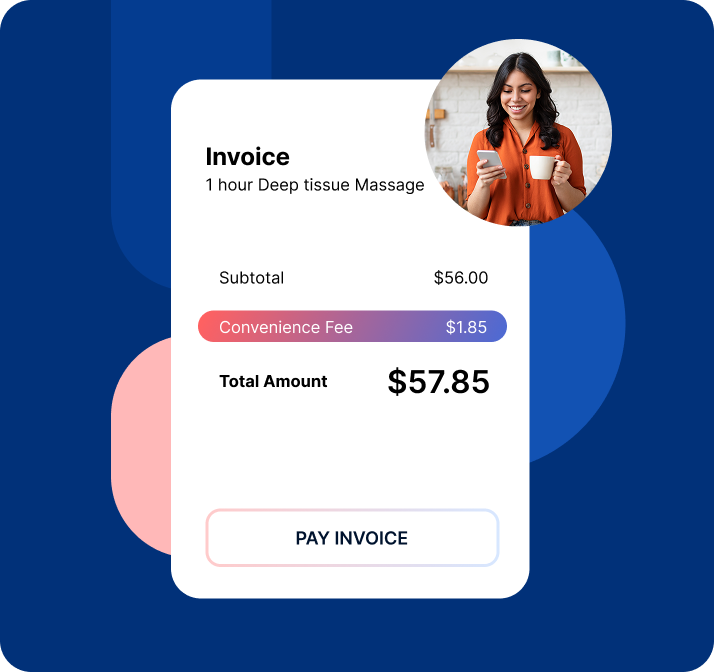

Here’s how it works

.png?width=700&name=Component%201%20(3).png)

1. Get Set Up With Surcharging

We configure your POS or payment system to automatically add a small fee when a customer chooses to pay by credit card — staying fully compliant with local regulations and card network rules.

2. Notify Customers

Clearly

Clear signage and receipt-level disclosures let customers know about the credit card fee ahead of time. They always have the option to pay with debit or other fee-free methods.

3. Keep More of What

You Earn

You recoup the cost of credit card processing — without raising your prices. That means more money back into your business, month after month.

Your revenue. Your rules.

Not sure if it’s right for you?

We’ve got you covered.

Why Customer Driven

Growth? Atom’s

Philosophy, Explained

Lorem ipsum dolor sit amet. In nihil repellendus ut deserunt excepturi

aut natus culpa. Cum quia illo et

enim aliquam sed vero dolorem

sed quisquam sunt.

Frequently asked questions, answered.

Credit card surcharging is the practice of adding a small fee to a transaction when a customer chooses to pay with a credit card. It helps businesses recover the cost of payment processing. We deep dive into this topic in our comprehensive guide to credit card surcharging.